Sectors of the stock market

Contents:

The food, beverages, and tobacco companies come under dissect. Also, the manufacture of household goods, personal products, and supermarkets make a part of the sector. The sector is defensive because these companies Recover quickly in the event of an economic downturn.

Various stocks are accessible to play an important part in the establishment of new houses and residences. Additionally, these are made available for rent, which brings in money. The main source of income in the real estate industry is the rent from these homes, offices, and other locations. Excellent and successful industries are essential to every economy. The industrial sector has a large number of companies on the stock market.

- The oil and gas exploration and production companies and those producing consumable fuels- coal and ethanol are included in this sector.

- The table below shows sectors along with their overview and performance metrics such as market cap, volume and number of stocks.

- In summary, sectors group several stocks based on similar business models, allowing investors to zoom in on a particular industry and identify a particular stock.

- This growth is likely to be driven by increasing disposable income.

- The term technology sector is frequently shortened to tech sector and is used interchangeably with the term technology industry in India.

The industry includes gas and oil companies and the producers of various other renewable resources like ethanol and coal. The sector includes media firms, apparel companies, etc., that serve as a luxury for customers and are not an ultimate survival demand. You can make use of different parameters that eventually help you in doing a proper analysis of stocks and hence taking investment in the right direction.

Main Sectors in NSE share market

You can discover the finest stocks inside the sectors that are driving the market higher during an uptrend. Investors can use different time frames within charts to find a trend before selecting a sector or stock. Determine the industries that are performing better than the entire market. As economic conditions are always shifting, there is no single industry that consistently performs well. According to this year’s investing cycle, infrastructure, banking, and power stocks are some of the most promising industries.

The energy sector or industry includes companies which are doing exploration & distribution of oil or gas reserves, oil and gas drilling, and refining. Although the economy has suffered due to the pandemic, markets are on the path to recovery. For any investor with clear goals and an essential understanding of sectors and sectoral funds, 2021 brings new opportunities. In addition to research regarding the best sector funds and schemes to invest in, it would help to consult a financial expert and get your queries clarified. Since global investors moving out of China have India on their radar as a potential market, chemicals may be a promising sector this year. For Indian investors in 2021, this is one of the most lucrative options when it comes to sector funds.

Consequently, a sectoral approach to investing enables one to account for this differentiation. Read ahead to learn more about the different sectors in stock markets with a special focus on the Indian equity space. Various companies provide oil and gas to the general public.

Banks’ profits are obtained from the cash flows of every other firm in the market. Biologicals; Active Pharmaceutical Ingredients; Excipients; Vaccines; Cures for Regular and Rare Diseases – are just a few of the many products from the pharma industry. Thanks to the COVID-19 pandemic, the industry is gaining familiarity amongst investors. The industry is strictly regulated because the products are concerned with the well-being of global citizens. So even during bad days for the wider economy, your neighbourhood grocery stores would be busy selling products of FMCG companies. FMCG companies are engaged in manufacturing products that we buy and use regularly.

Popular In Markets

This post will go through some of the best-identified equities based on their share market sectors. This acceleration is reflected in the performance of the IT stock market as well, making sector funds in this segment an advantageous investment. The banking sector in the Indian stock market includes companies that offer banking and financial services. Many of these companies are dedicated to holding financial assets for others, and they invest those financial assets as a leveraged way to create more wealth. India’s banking sector includes a wide network of various kinds of banks and banking solutions. Health care is an integral component of every economy, making it an important stock market sector.

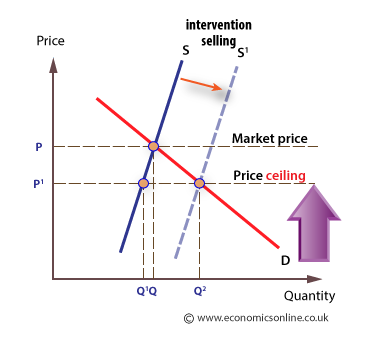

Some sectors may be hit badly during economic downturns while others may still outshine others during a recession. 2023 economic conditions in the US are signaling a recession next year. As per our understanding from previous units, we know by now, the stock market works on the concept of sector rotation.

Health care Sector

Thanks to a 102 per cent gain in its stock price, Max Healthcare is in second place. India is currently the world’s third-largest energy consumer, after the US and China. Speaking of outperformance, metal would be one of the best sectors to invest in the Indian stock market for the long term.

Rows and rows for chocolates, biscuits, savories, skincare products, hair care solutions, soft toys, outdoor sports, and perhaps even a section for clothes. In addition to these two, I would also look at automotive and auto ancillary. Both these industries have been coming off over a period of 4-5 years of weak growth. For the last one year, we have been seeing positive numbers and the outlook for the next couple of years is rather positive. However, this is based mainly on current data and we generally don’t use forward estimates. It is hard to predict how the algo will react because it is hard to predict how the inputs will change over the course of the year.

Bank of Montreal Can Diversifies its Portfolio with Strategic … – Best Stocks

Bank of Montreal Can Diversifies its Portfolio with Strategic ….

Posted: Fri, 28 Apr 2023 10:38:53 GMT [source]

All of the leading indices have hit fresh all-time highs in recent weeks. I explained to them that this euphoria and profitability of aviation companies is due to the low price of jet fuel. Moreover, a big IPO of market leader will hit the market shortly. Aviation cannot be a long term growth story for Equity Investment. The fuel prices are solely responsible for the profitability during last 2 quarters. The prices of jet fuel will not remain low forever and it is major cost component.

List Of Best Sector-wise Stocks (As on 2nd November

One that sells vegetables, another that has a variety of fruits on display, and a third that offers a variety of local, handmade https://1investing.in/.

Will Travelcenters of America Inc (TA) Stay at the Top of the Consumer Cyclical Sector? – InvestorsObserver

Will Travelcenters of America Inc (TA) Stay at the Top of the Consumer Cyclical Sector?.

Posted: Wed, 26 Apr 2023 15:09:49 GMT [source]

Since 2011, the country has been the fourth-largest Liquefied Natural Gas importer after Japan, South Korea, and China. Now you must be wondering that i have excluded so many sectors from Equity Investment then where to invest. As an investor, which sectors are profitable for equity investment. For the time being, i am avoiding Equity Investment in above mentioned 7 sectors. The basic materials sector is a category of stocks for companies involved in the discovery, development, and processing of raw materials.

Different Sectors In the Indian Stock Market

This will also act as a primer to what we’re going to be seeing in the upcoming chapters of this module. Fundamentally, a sector is an area of the economy that’s made of companies engaged in similar lines of business. This could involve the manufacture or sale of products or services. The stock market is also divided into sectors to reflect the way the economy is partitioned.

A sharpe ratiors should have knowledge about this sectors in NSE market to avoid a loss in stock market. Investors utilise sector rotation to hold overweight holdings in strong sectors and underweight positions in weak sectors. Exchange-traded funds that focus on particular industry sectors provide investors with a simple opportunity to participate in the rotation of an industrial sector. While long-term investments are far superior to other types of investments, you should not exceed your investment budget in hurry. Instead, set a predetermined sum and invest it in a variety of solid stocks. Rather than investing in just one stock, spread your funds evenly among several high-performing equities and shares.

The finance or the financial sector includes everything related to investing, finance and handling money in the economy. Many banks that are part of the banking sector also come under the financial services sector. The stock market has been divided into many sectors because of its rapid growth. However, the question of how many stock market sectors remains.

As the stock market has grown in prominence, numerous stock market sectors have emerged. This can meet the demands of all investors and simplify the management of their holdings. With the growing popularity, there are now different stock market sectors that can cater to all the investors’ needs and make it easier for them to manage their portfolios. There is a slight overlap with the pharma sector here, as you may have noticed. Even though most industries were severely affected, they have made tremendous strides forward.

- The stock market’s healthcare sector includes medications, hospital management, pharmaceutical businesses, medical equipment makers, and so on.

- To compare the share of different companies with each other, we categorise the companies based on similarity in their business model under various sectors.

- Following the main sectors representing key areas of the economy.

- All of the leading indices have hit fresh all-time highs in recent weeks.

These drugs are used as medications that are administered to patients, and they include a variety of products like tablets, tonics and vaccines, among others. NBFC is a similar story again and for both banks and the NBFCs, the NPA cycles have been favourable. They have been trending down and there is a stock correction to offer. The Consumer staples sector consists of food and beverage companies. Though there are some companies which a customer can avoid to buy when there is a economic downturn or a war like situation in the country.

On a rolling basis, stocks which come in top 80% of total market-cap are considered largecaps, next 15% midcaps and remaining 5% smallcaps. Aside from the key sectors mentioned above, we also have a number of other sectors that our markets have been developed to include. The pharmaceutical sector, abbreviated as the pharma sector, consists of companies that discover, develop , produce, and market pharmaceutical drugs.